Decarbonization in Real Estate: How Buildings Become Climate Assets

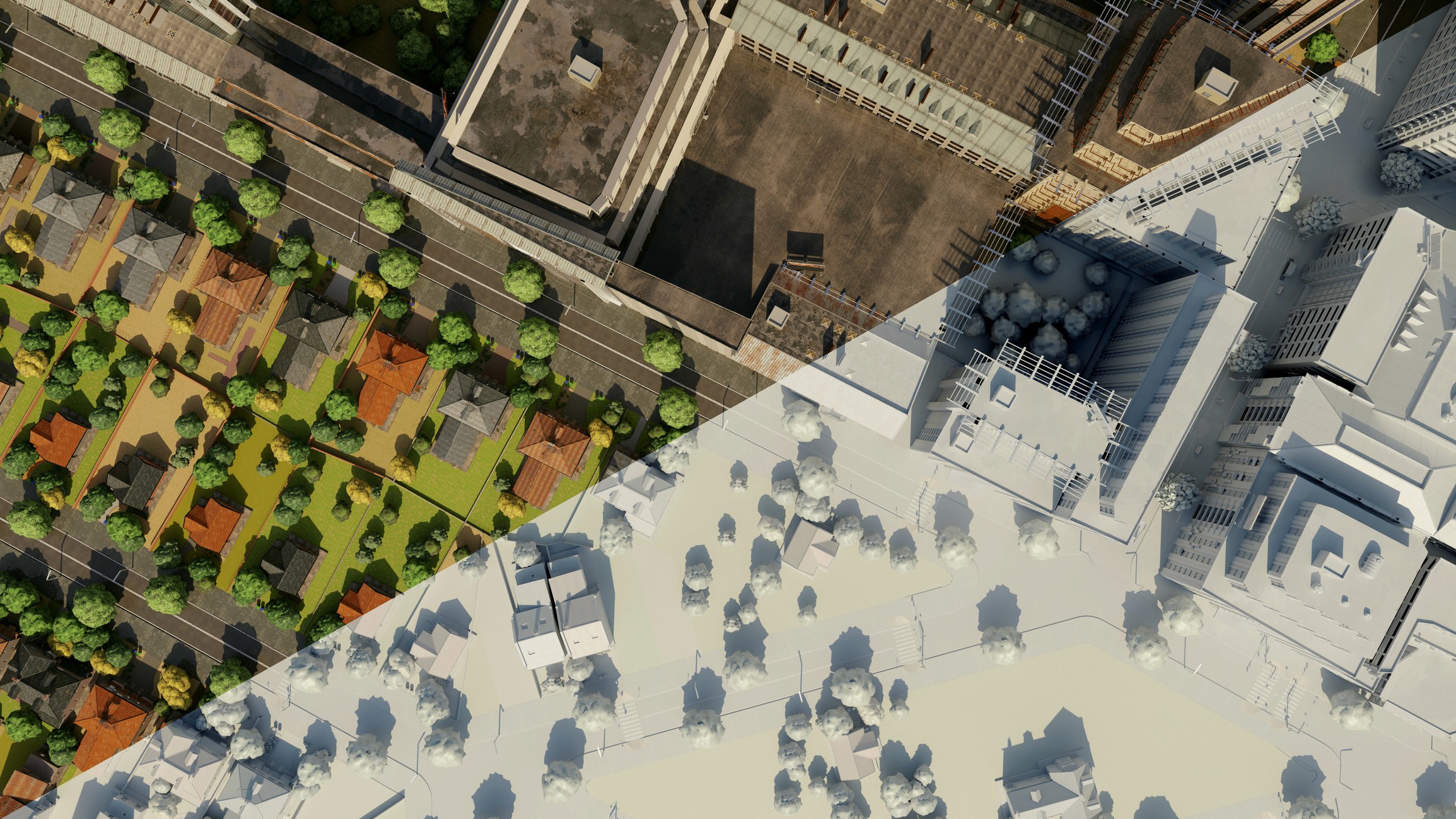

Photo Credit: themiex - iStock

Decarbonization in real estate has finally reached a turning point. For years, buildings were framed as a problem sector, responsible for close to a third of global emissions, difficult to retrofit, and slow to change. Now, a different picture is taking shape. Smart grids, advanced building management systems and AI are beginning to show that large, complex portfolios can cut energy waste and carbon output in meaningful ways, without waiting for every asset to be rebuilt from the ground up.

At the same time, ESG frameworks, investor pressure and tightening regulations are pushing owners and operators to prove that their buildings are aligned with net zero pathways, not drifting toward stranded status. The climate crisis has made the stakes clear. This article explores where decarbonization in real estate stands today, what is working in practice, and which innovations will define the next decade.

Decarbonization Moves From “Nice to Have” to Non-Negotiable

The built environment is no longer a side note in climate strategy. When accounting for operational emissions and embodied carbon, buildings can represent close to 40 percent of global energy related emissions. That reality is now colliding with three forces the industry cannot ignore.

First, ESG is becoming a core value driver.

Investors, lenders and tenants are treating decarbonization performance as a signal of long term value, risk and resilience, not an optional reporting exercise.

Second, digitalization is transforming building energy behavior.

Grid interactive buildings, powered by smarter control systems, can now adapt energy use in real time based on occupancy, weather or grid conditions.

Third, operational AI is becoming a practical way to cut emissions today.

AI is already transforming how real estate predicts demand, manages assets and responds to changing conditions, as we explored in AI Is Writing the Next Chapter in PropTech and Real Estate. Instead of waiting for deep capital projects, owners can deploy software that optimizes HVAC and controls hour by hour, room by room.

These shifts are moving decarbonization in real estate away from isolated pilot projects and toward system level transformation.

From Smart Grids to AI: What Decarbonization Looks Like in Practice

The technical toolkit for decarbonizing buildings is already more mature than many assume. Recent research and announcements illustrate what “good” looks like when these tools are deployed effectively.

1. Grid Interactive Buildings and Advanced BMS

When smart grids connect directly with building management systems, buildings stop functioning as static energy loads and begin behaving as responsive assets.

According to the PRISM Sustainability Directory, integrating smart grids with advanced building management systems can reduce commercial building energy use by 10 to 30 percent. Those gains tie directly to lower emissions, stronger ESG performance and reduced operating costs.

Smart grids provide real time visibility into energy availability and stress levels, while BMS platforms orchestrate HVAC, lighting, shading, security and on site generation. Together, they unlock flexible demand response, load shifting and better integration of rooftop solar and battery storage.

2. Platforms Like ABB Ability BuildingPro

Vendors are reshaping how building operations are managed at scale.

As reported by Informed Infrastructure, ABB has launched its Ability BuildingPro platform, designed to unify building data, strengthen cybersecurity and support decarbonization across entire property portfolios. The platform blends edge controllers, cloud connectivity and open standards to help teams monitor, control and optimize performance in real time.

Tools like this make decarbonization practical for owners with diverse buildings, legacy equipment and varying operational maturity levels. They also help meet escalating reporting and compliance requirements tied to emissions and energy performance.

3. AI as a Digital Retrofit for HVAC and Energy Optimization

AI’s energy footprint gets significant attention, especially in the context of data centers, but that is only half the story. Inside buildings, operational AI is becoming one of the fastest ways to cut emissions.

According to Electronics Media, experts from Exergio warn that operational AI remains overlooked in global climate plans, even though AI driven HVAC optimization reduces energy use in large commercial buildings by 20 to 30 percent. Their deployments across Europe and the Middle East show that AI can act as a digital retrofit, continuously adjusting HVAC output, shifting cooling to off-peak hours and responding dynamically to weather and occupancy.

For real estate owners, this creates a rare combination of immediate emissions reductions and meaningful cost savings.

4. AI Scaling Across Renewable Energy and Smart Grids

Beyond individual buildings, AI is transforming how renewable energy integrates with the grid.

As highlighted by Allied Market Research, the market for AI in renewable energy is set to grow from $0.6B in 2022 to $4.6B by 2032, driven by AI systems that improve solar forecasting, optimize wind turbine operation and stabilize smart grids. For real estate, this means the grid itself is becoming more predictive, more flexible and more compatible with buildings designed to participate in energy markets.

The better the grid performs, the more effective on site technologies like solar, storage and demand response become.

Why Decarbonization is Now Core Real Estate Strategy

The technical advancements are significant, but the human and organizational factors may prove even more influential.

1. Over 140 Barriers Highlight the Need for Cross Sector Coordination

According to research from Boston University’s Institute for Global Sustainability, produced in partnership with Schneider Electric, more than 140 sociotechnical barriers are slowing building decarbonization. These include high upfront costs, limited awareness, performance concerns, regulatory gaps and conflicting stakeholder priorities across the building lifecycle.

This reinforces an important truth. Decarbonization in real estate must be a social, economic and organizational transformation that spans design, construction, operations and long term asset management.

2. ESG Is Recalculating Value

As ESG standards tighten, emissions reduction has become directly tied to asset value and risk. Buildings aligned with net zero pathways attract stronger demand, are more likely to qualify for green financing, and face fewer transition risks.

As reported by SugerMint, ESG frameworks are reshaping decarbonization strategies across real estate, energy and agriculture. Investors now treat carbon performance as a material driver of return on investment, not a marketing category.

Buildings that fail to decarbonize risk becoming brown or stranded assets in the coming decade.

3. Interoperability and Data Quality Are Non-Negotiable

Interoperability sits at the heart of all of this. As we outlined in Matter 1.5 Is Here, What It Is and Why It Matters, the ability for devices, platforms and systems to speak the same language determines how reliably a building can operate, optimize and scale.

Disconnected systems slow everything down. Buildings need open standards, consistent data models and platforms that can unify information from different devices and vendors. Without this foundation, performance claims, ESG reporting and AI optimization become unreliable.

4. Decarbonization Requires Behavioral Buy-In

From facilities teams to occupants, human behavior influences energy use. User friendly interfaces, transparent communication and training are essential to maximizing the impact of any digital or low carbon intervention.

From Single Buildings to Integrated Decarbonization Systems

The next decade will mark a shift from isolated retrofits to integrated decarbonization systems spanning buildings, grids and entire portfolios.

Expect to see:

Portfolio level optimization powered by unified data platforms

Convergence of PropTech, smart home and city infrastructure

Growth of decarbonization-as-a-service models that reduce upfront cost barriers

Heightened focus on embodied carbon and full lifecycle impact

Digital twins for monitoring, forecasting and verification

AI supported operations that become standard for large buildings

The most competitive portfolios will be those that are digitally visible, grid aware and AI ready.

Turning Buildings Into Climate Assets

The climate crisis demands that real estate move faster and more decisively. The good news is that many of the tools needed to cut emissions are already here. Smart grids, advanced BMS platforms, AI driven optimization and evolving ESG frameworks offer a practical path forward that reduces cost, improves resilience and strengthens long term asset value.

If owners and operators commit to open standards, credible measurement and user centric design, buildings can shift from being climate liabilities to becoming climate assets. If not, today’s high emitting buildings risk becoming tomorrow’s financial and regulatory burdens.

The choice is in motion. Every system upgrade, every platform decision and every retrofit plan either accelerates decarbonization or stalls it. The most successful portfolios will be those that act now, not later.