Institutional Capital, Grid-Strain, and the Search for Climate-Aligned Real Estate Resilience

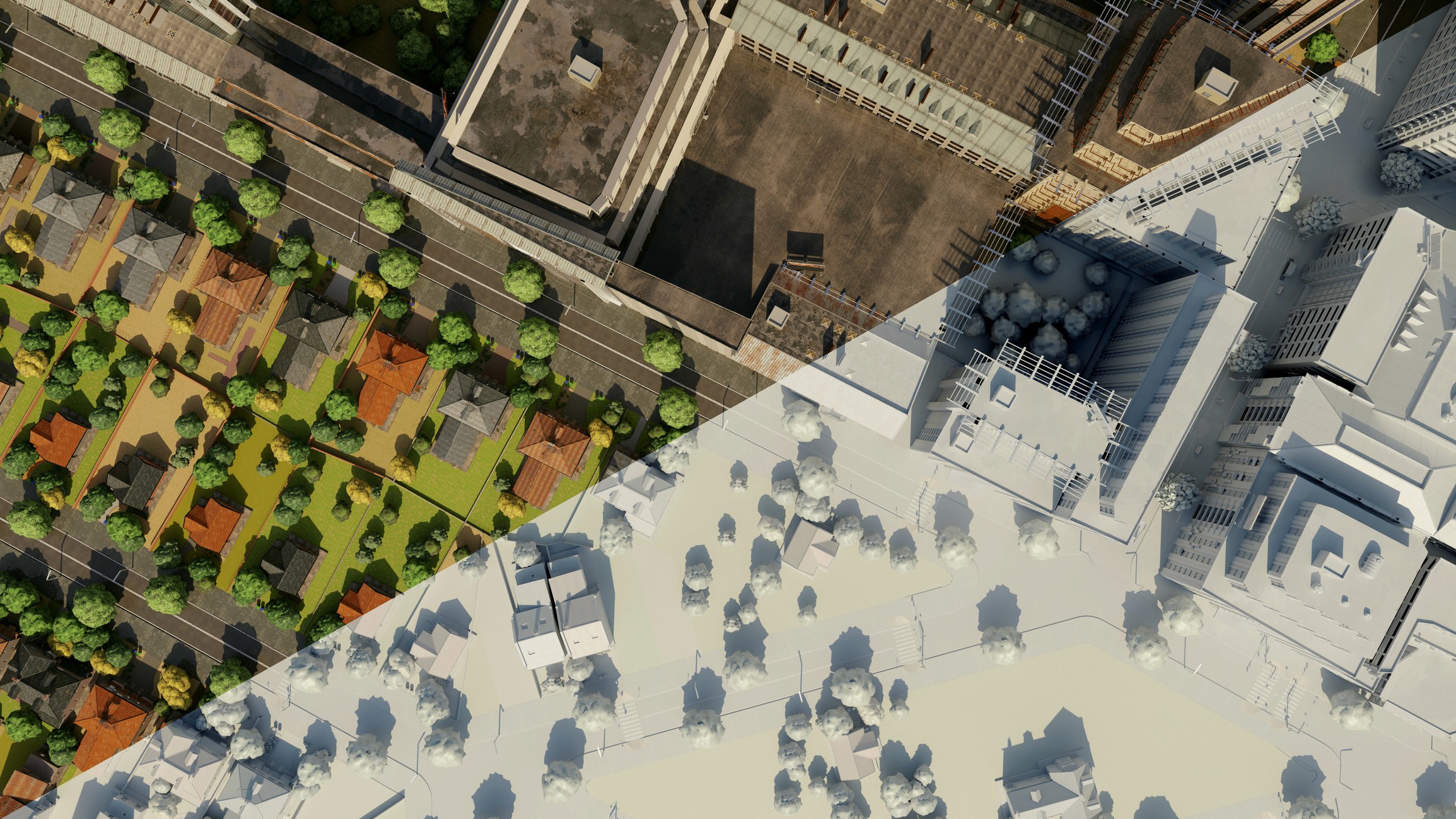

Photo Credit: Maho - iStock

Buildings are turning into core participants in infrastructure and financing systems, faster than most headlines ever predicted. Institutional investors are rotating capital out of vulnerable retail REIT models, AI is straining power networks at hyperscale, and climate-finance frameworks are becoming essential for durability across global portfolios.

Macroeconomic signals for 2026 point to moderate GDP growth, persistent disinflation, and easing interest rate pressure, conditions that will improve liquidity for some investors while exposing infrastructure limits for others. Markets where strong leasing fundamentals pair with adaptable, grid-aware energy systems are positionally optimistic, while legacy retail formats oversold against digital commerce are fading. This piece brings these intersecting signals together to examine what will define resilience in 2026: decentralized grid systems, innovative financing stacks, climate underwriting, and open connectivity standards.

For a forward lens into how AI is reshaping portfolio durability at scale, see our deep dive on AI’s role in PropTech & Real Estate: AI is writing the next chapter in PropTech & real estate, detailing real time portfolio returns and infrastructure sequencing needs, a shift our industry is watching carefully.

The AI Load Reset, Why Buildings Are Becoming Grid-Edge Devices

Global Energy Markets are facing immediate power demand challenges from artificial intelligence infrastructure. The moderate GDP growth + AI infra moment is poised to stress utilities planning cycles.

Commercial portfolios are becoming smart-grid participants through device-level data unification and grid-edge partnerships. Buildings speaking over low-power mesh protocols like the Thread Protocol are transforming static asset formats into dynamic infrastructure players able to schedule load, unify fleet intelligence, and sequence electricity peaks with greater reliability.

This matters, because disconnected systems slow everything down. For an earlier breakdown on how real estate systems connect at protocol level, see Matter 1.5 is here, what it is and why it matters, a connectivity layer increasingly tied to building resiliency, with granularity that makes claims feel credible for owners who need reliability.

Electricity load balancing used to be a utility-only conversation. Now, with AI campus expansions pushing gigawatts in demand, building portfolios need to answer: can we schedule electricity without compromising portfolio retention, occupancy, or affordability?

Retail Is Losing Institutional Love, Multifamily Is a Local Durability Story

The structural fragility of retail real estate models can be seen through the liquidation cycle of the former retail REIT category. The liquidation wave accelerated by E‑commerce Disruption shows traditional retail losing institutional confidence.

Investors are rotating capital toward market-by-market resilient formats. Multifamily portfolios nearer to demand fundamentals, pricing durability, and decentralized digital intelligence adjacency are seeing selective institutional optimism.

Bangladesh’s 2026 energy transition financing signals another important lens: their ability to allocate 20% of term loans to sustainable sectors shows structurally aligned lending achieving climate and economic durability simultaneously. That model depends on decentralization: local authority, financing models made to hedge against tenant concentration risk, and consistent public financial awareness for green lending.

For a stronger look into why local fundamentals are defining REIT durability outside legacy retail, see Multifamily REITs Show Mixed Outlook as Q4 Begins, which underscores that tech adjacency, limited new supply, resistance to pricing cracks, and expense management are becoming future-proofing levers investors now assess institutionally.

Green-First Financing, Bonds and Alternative Credit Unlocks

Bangladesh’s lending and financing policies show that green financing isn’t optional, it’s capital planning. Banks instructed to allocate 20% of term loans and 5% of total term exposure to sustainable green projects show climate finance that unifies stakeholder awareness and structural resiliency.

This shows international institutional confidence moving toward markets where lending is climate-aligned from the ground-up. For a global capital behavior unlock moment, see Global 2026 outlook and its impact on energy utilities and commodity markets which shows that valuations aren’t just being priced by leasing activity alone but by durable infrastructure confidence that can handle fivefold jumps in data-campus electricity demand.

For another capital unlock moment, markets tied to policy reforms like Saudi Arabia’s 2026 Freehold Property Ownership are geopositioning portfolios into new institutional confidence corridors, especially where foreign financing and ownership reform de-risk long-term durability for investors and developers.

For an example of necessity-based capital that remains stable even in volatile pricing eras, utility-adjacent necessity retail portfolios speaking over mesh and financed by alternative credit formats are earning selective investor attention for 2026 survival.

PropTech 2026 Must-Solve List, Interop, Load Balance, and Climate Underwriting

Going into 2026, PropTech must solve for:

1. Grid-Aware Load Orchestration

Schedule electricity without cracking portfolio occupancy or affordability. Grid-instrumented buildings speaking over Thread will out-orchestrate static consumers.

2. Open Standards Data Unification

Standardize how systems talk before you scale. Platforms that reliably unify endpoints and mesh hubs will outrun retail fragility.

3. Climate-Underwritten Portfolio Durability

Market-by-market heat risk and disaster vulnerabilities need climate underwriting baked into credit stacks.

4. Alternative Finance, Green Bonds and Private Credit

Traditional capital alone won’t finance gigawatt load jumps. Institutional attention is shifting into private credit and green bonds.

5. Social Equity in Capex Planning

Prevent outsized impact on vulnerable residents. Capex now includes power, pricing and social durability KPIs.

Portfolios that can schedule electricity without compromising affordability or retention, speak in open standards like Thread Protocol, and innovate on climate-finance stacks are becoming real benchmarks for resilience.

The asset story is becoming an energy story. Markets aligned to green-first credit frameworks, decentralized local authority stacks and grid-edge intelligence will be more durable and earn tomorrow’s institutional attention.